Forex trading has developed over the years. Thanks to modern technologies, anyone can make a living from forex trading. There are different types of forex traders, but all traders can be classified either as professional traders or hobby traders, depending on certain factors. Both professional and hobby traders do forex trading online. But other factors differentiate them. One such factor is the time spent trading daily.

What is Forex Trading?

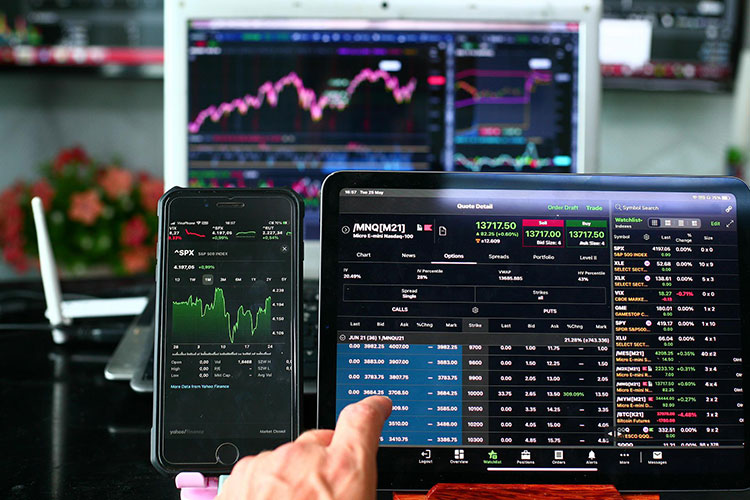

Forex trading refers to all currency trading activities on the global foreign exchange market. Forex traders take advantage of price differences between two currencies to make profits. Foreign exchange trading has been around for decades, during which only large financial institutions had access to the forex market. But the advent of the internet and mobile devices lowered the entry barrier, ensuring that anyone today can trade foreign currencies with the push of a button. Forex trading brings many benefits and advantages to traders.

Benefits and Advantages of Forex Trading

Here are the top benefits and advantages of forex trading:

- A way to earn an income. Forex trading presents an opportunity for anyone looking to make money consistently.

- Forex traders enjoy a flexible lifestyle. As a trader, you can trade when and where you want without the restrictions of trading opportunities.

- The forex market is global, highly liquid, and open 24/5. It is the biggest financial market, with daily trading volumes worth trillions.

- Low trading cost and entry barrier. Anyone can trade forex today, provided there’s a working internet.

- Forex trading improves the international economy.

Who is a Professional Forex Trader?

A professional forex trader is also called a forex account manager and refers to a forex trader that trades for corporate institutions and manages individual accounts. Professional traders make trading decisions and get paid for them. That’s one reason there are fewer professional forex traders today than hobby traders. But the term professional also loosely applies to anyone who trades for a living, not just part-time or as a hobby.

How Do Professional Forex Traders Trade?

Professional traders have access to supercomputers that are unbelievably fast. They also have access to better trading tools that sharpens their trading decisions. Because they mainly trade huge portfolios for large financial institutions, professional traders are sometimes called market movers or institutional traders. Where retail and hobby traders cap their trading capital at a few million, professional traders manage portfolios with a base amount worth millions. If you’re new to trading, VectorVest provides guides and strategies that can be of help as you progress.

Factors That Affect Trading Time

Here are four key factors that determine how long a professional spends on the market daily.

Trading session

The forex market is open 24 hours a day from 5 pm EST on Sunday until 4 pm EST on Friday. There are four major forex trading sessions:

- New York (8 am – 5 pm EST, 1 pm to 10 pm UTC)

- Tokyo (7 pm – 4 am EST, 12 am to 9 am UTC)

- Sydney (5 pm – 2 am EST, 10 pm to 7 am UTC)

- London (3 am – 12 pm EST, 8 am to 5 pm UTC)

Since the trading sessions overlap, professional traders can trade all day until all markets close for the week.

Research and Analysis

Every professional trader understands the power of research and analysis. And that’s one thing that takes a significant chunk from the trading time. Traders spend hours reading, following global events, and analysing charts to find the best trading setups. Professionals typically spend hours on that daily.

Market conditions

It is impossible to force the market to move according to your predictions. All traders follow the market and not otherwise. Since most market factors are beyond the traders’ control, traders must patiently wait for profitable trading setups. Professional traders know to wait until market factors favour them. That contributes to the time spent trading daily. Traders may not trade if they don’t find the market profitable.

Lifestyle choices

The time traders spend on the market is also determined by their lifestyle choices. Some traders love to monitor and analyse the market even when they are not actively trading. Lifestyle choices also include the type of forex trading that traders do:

- Day trading: day traders use strategies such as scalping and finish all their trading within a day. Day traders may spend hours entering and exiting trades, but make sure to close within a day.

- Swing traders: swing traders follow the price swings of an asset. They sell at high prices, buy at low prices, and do not trade when the price ranges. Swing traders may spend a few hours each day waiting for prices to reach their marks. They, however, often allow trades to last more than a day.

- High-frequency traders: professional forex traders with access to high-speed and performance machines often perform high-frequency trading where supercomputers execute many trades within seconds. Such supercomputers are often unavailable to retail or hobby traders.

Final Words

The number of hours professional traders spend on forex trading depends on factors such as their trading skills, trading style and strategies, and research. Trading hours differ from one trader to another, but professional traders spend long hours analysing the market before making trading decisions. Professional traders may also stay in a trade longer than hobby traders. In the end, professional traders spend much longer on forex trading daily.

related store

TBD

Leave a Reply