Since it is really challenging to apply for credit card with bad credit, the consolidation and elimination of expensive credit card debt may be accomplished effectively via the use of personal loans. The cash can be used toward covering essential expenditures. Personal loans may be useful for a variety of reasons, including paying unexpected bills or making improvements to your property.

An individual can also divide the expenses for a significant purchase into many installments in addition to making the overall cost more affordable. Moreover, your credit score can be lower than you would want it to be if you have a debt load or if you have a history of paying your bills beyond the due date in the past. Having bad credit may be a distressing disadvantage, especially when trying to convince creditors to trust your capacity to repay them.

If you need to pay for unexpected costs or consolidate your debt, a payday loan may be the best option for you. While still having a poor credit score will result in higher interest rates, it is still feasible to get a payday loan with bad credit if you take a few easy steps to elevate your score and shop around with credible lenders.

In order to better understand this, we have created an article below which you can go through to gain proper information.

Impact of Payday Loans

When you’re strapped for cash, it might be difficult to resist the urge to look for quick fixes to your financial problems. Payday loans are short-term, unsecured loans that do not require you to have a savings account or any other kind of collateral in order to get one. Payday loans are easy to get and don’t take much time to process.

In contrast to other types of loan products, you may submit your application online in a matter of minutes, and the funds may be sent to your local bank in 24 hours. Payday loans are popular among borrowers in need of quick cash since they tend to have more lenient approval standards than other types of loans.

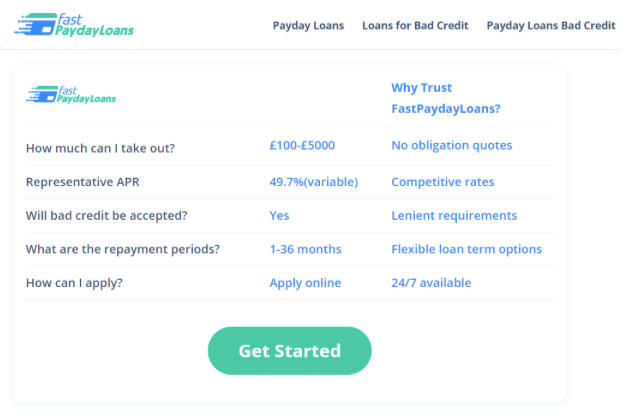

Payday lenders are more likely to accept borrowers with bad credit scores and poor credit histories and one such platform which is ideal for such loans is Fast Payday Loans. This platform with its extensive list of lenders and instant quotes helps all its low credit score customers with complete concern and attentiveness.

These loans, however, despite the fact that they seem to be quite simple, can come with extra costs that might eat into your total expenses more than you would imagine. Unfortunately, the interest rates and fees associated with these loans are over the roof. It is essential for borrowers to proceed with extreme care when dealing with these loans.

The application process for payday loans may normally be completed either in person at a lending establishment or online. They are subject to regulations not only at the state level but also at the federal level.

Considerations for Finding the Most Reliable Payday Loans for Bad Credit

The co-founder Camila Henderson of Fast Payday Loans (click to learn more about this UK loan platform) said that people with bad credit histories are common beneficiaries of payday loans. These are designed for regular individuals who may need a little extra help when circumstances are rough, whereas loans from established banks and lenders tend to have stricter requirements.

In the event of an unexpected cost, these might be a lifesaver. You should verify the lender’s legitimacy to avoid any problems. For this purpose, you should consider some important points mentioned below before opting for a lender that can accept bad credit loans.

Check For Credibility

Before they may legally provide loans, lenders need to be registered with the appropriate authorities in their jurisdiction. The costs of borrowing money should be fully stated by the lending institution.

Costs like those for the first application and credit report are often included in this category. The lending organization should have a steady stream of customers and should not be devoid of any clients.

Transparency in Fees and Commission

Try to find financial institutions that accept several payment methods such as direct debit, internet payments, phone payments, and/or postal checks. You shouldn’t have any doubts regarding how to conduct loan transactions if you’re dealing with a reputable lender that explains everything in detail.

They should have no excess fees or upfront fees which prove their credibility and taking this into account Fast Payday Loans offers great deals with instant online application approvals. You can secure payday loans for bad credit from their website easily and get upto 5000£ within 24 hours.

Read the Contract’s Terms and Conditions

No matter the size of the loan, external financing is a major undertaking, therefore a formal loan agreement should be in place to safeguard both parties. Not only does a loan agreement spell out the repayment conditions, but it also proves that the borrowed funds or other assets were not given to the borrower as a gift.

Make sure that the organization has no hidden fee and is not charging you excess late payments or extra fees. Also, take a look at and discuss the commission with the lenders so that you have a clear understanding of the whole amount due before diving into such a loan.

Easy Application Process

The application procedure ought to be uncomplicated and accessible to those with poor credit. A simple online application is all that should be required of you to get a loan. In the event that you need to apply online, fill out a lot of paperwork, or and in other cases, pay a long visit, or contact the lender repeatedly shouldn’t be necessary. The borrower should be able to acquire a quotation in a few easy steps.

Conclusion

Most payday lenders want repayment within two to four weeks, on the borrower’s next payday. Secure and easily accessible, these limited loans may help you stretch your budget where it most.

Check Into Fast Payday Loans’ offers are a great option whether you’re having trouble making ends meet or need emergency cash for bills or repairs. Hopefully, this article helps you better understand the things for finding reliable loans for bad credit.

Leave a Reply