Talking about finances may put a strain on any relationship. Whether you are just moving in together or are already married, having conversations about money is an essential part of your relationship. Besides, it’s inevitable. It’s much better to start discussing financial matters before you plan to have a baby or get a mortgage so that you can avoid taking payday loans no refusal in an emergency, and instead create mutual monetary goals and work your way toward them.

While your life together may include some curveballs and bumps, it’s definitely rewarding to discuss your financial health and plan joint projects. Here is how to budget as a couple and make this process less daunting and more effective.

Ways to Deal with One Spouse Earning More Money

Each couple decides how they want to split their expenses. Some families use a fixed percentage while other households split costs depending on each spouse’s income. What do financial experts suggest? They recommend that Canadian couples think of this matter as a team. If your incomes are different, it may be awkward to split the expenses evenly as it won’t reflect how difficult each spouse works.

The incomes in one family may differ a lot even though every spouse works hard. Thus, it may be unfair to divide the monthly expenses into half if one person earns more than the other one. If you look at your couple’s income as a whole you will be able to decide on expenses and lifestyle that will work best for both of you. The person who makes more money pays more. This is a more suitable option while disagreements can happen if your joint funds are tight.

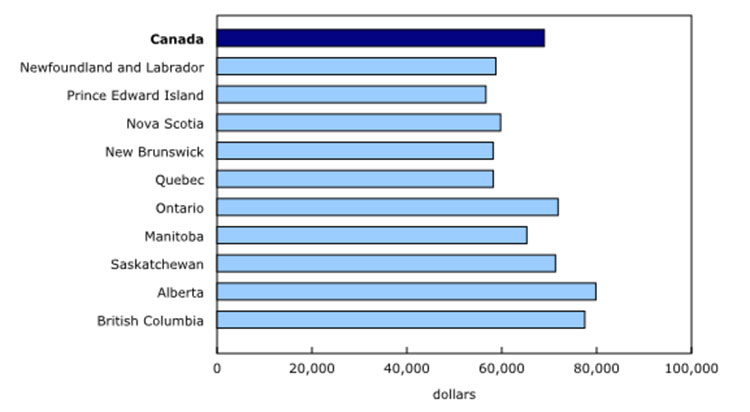

Canadian households dedicate the largest share of their spending to housing, transport, and groceries. Almost two-thirds of total household spending on services and goods are allocated to housing (29.3%), transport (18.5%), and groceries (14.9%), according to Statistics Canada.

How to Budget Effectively As a Couple

1. Decide on Your Monetary Aims

When you are about to make a budget, it’s important to define your financial targets, both individually and as a couple. The more realistic your financial plan is, the more likely you will reach these aims.

It can often be challenging and stressful to make money-related decisions or talk about money but it’s the only way for you to manage this stress and get on the same page with your spouse. When you create a plan and understand what each of you wants, it will be easier to focus on your goals, prioritize your spending, boost savings, and invest in your future together.

You may choose one of these goals to create your joint budget:

- Traveling as a couple. You may want to set individual and joint travel budgets. Financial coaches recommend 5% of the monthly income but each couple may decide for themselves.

- Repay current debt. Every couple should focus on debt repayment. If you have a student loan, multiple credit cards, or lines of credit, you need to prioritize your spending to pay these types of debt first.

- A wedding. It’s a great idea to get married. However, this plan also required a lot of money. If you understand that this is something you really want to have as a couple, you need to plan such expenses ahead.

- Purchasing property. The majority of Canadians dream about becoming proud homeowners. Is it your dream as well? Then it’s time to discuss your plans with another spouse. Purchasing your own home means a lot of additional expenses such as legal fees, insurance, furniture, and moving costs. An online mortgage calculator will be helpful to estimate these expenses.

- Kids. You should talk about the costs associated with children before you even plan to have them. Having kids is incredible but it’s also very expensive. Once the child is born, parents may take part in a Registered Education Savings Plan (RESP) to help them finance the education costs of their kid.

2. Determine Your Sources of Income

Make sure you define all sources of your monthly income. Do you have a regular full-time job? Do you also have a side hustle or additional income stream? Make sure you add up all rental income, bonuses, salaries, subsidies, tax credits, gifts, etc. This way you will see the whole picture of how much you have for reaching your financial goals.

3. Decide How to Divide Costs

This is the hardest part but it’s also essential for each couple. You can’t simply postpone this decision. Have you discussed your near- and long-term aims? Are you on the same page with your spouse? Get ready for this difficult conversation with your partner. Try to be honest and open to discussion.

Think about the most suitable way to split your expenses. You need to divide utility bills, groceries, transport expenses, etc. Some couples decide to split the budget in half. Others prefer a higher contribution from the one who makes more money. Think as a team and find out what works best for your couple. This plan may help you feel more connected and understand what each of you expects in a relationship.

4. Set Limits for Spending And Saving

Each person has different limits when it comes to budgeting, spending, and saving. You can’t rely on lending options or credit cards all the time. It will be disappointing if one of you spends too much while the other one focuses more on savings.

It’s essential to set spending limits to get rid of unnecessary spending and know how well you both spend your funds. Moreover, discuss your saving expectations to get an idea of how much you will allocate toward your savings accounts and major long-term projects.

Conclusion

In conclusion, making a budget and managing it as a couple might be more challenging than when you do it on your own. You need to be more flexible and hands-on to achieve success. Budgeting as a family requires effort and dedication. If you set your financial goals as a couple, stick to them, and contribute your agreed part of income each month, you will both feel responsible for your well-being and reach your goals.

related store

TBD

Leave a Reply